In Game Theory, No Clear Path to Equilibrium

All games have a Nash equilibrium. But will players be able to reach it?

Eric Nyquist for Quanta Magazine

Introduction

In 1950, John Nash — the mathematician later featured in the book and film “A Beautiful Mind” — wrote a two-page paper that transformed the theory of economics. His crucial, yet utterly simple, idea was that any competitive game has a notion of equilibrium: a collection of strategies, one for each player, such that no player can win more by unilaterally switching to a different strategy.

Nash’s equilibrium concept, which earned him a Nobel Prize in economics in 1994, offers a unified framework for understanding strategic behavior not only in economics but also in psychology, evolutionary biology and a host of other fields. Its influence on economic theory “is comparable to that of the discovery of the DNA double helix in the biological sciences,” wrote Roger Myerson of the University of Chicago, another economics Nobelist.

When players are at equilibrium, no one has a reason to stray. But how do players get to equilibrium in the first place? In contrast with, say, a ball rolling downhill and coming to rest in a valley, there is no obvious force guiding game players toward a Nash equilibrium.

“It has always been a thorn in the side of microeconomists,” said Tim Roughgarden, a theoretical computer scientist at Stanford University. “They use these equilibrium concepts, and they’re analyzing them as if people will be at equilibrium, but there isn’t always a satisfying explanation of why people will be at Nash equilibrium as opposed to just groping around for one.”

If people play a game only once, it is often unreasonable to expect them to find an equilibrium. This is especially the case if — as is typical in the real world — each player knows only how much she herself values the game’s different outcomes, and not how much her fellow players do. But if people can play repeatedly, perhaps they could learn from the early rounds and rapidly steer themselves toward an equilibrium. Yet attempts to find such efficient learning methods have always come up dry.

John Nash’s work in game theory transformed economics.

“Economists have proposed mechanisms for how you can converge [quickly] to equilibrium,” said Aviad Rubinstein, who is finishing a doctorate in theoretical computer science at the University of California, Berkeley. But for each such mechanism, he said, “there are simple games you can construct where it doesn’t work.”

Now, Rubinstein and Yakov Babichenko, a mathematician at the Technion-Israel Institute of Technology in Haifa, have explained why. In a paper posted online last September, they proved that no method of adapting strategies in response to previous games — no matter how commonsensical, creative or clever — will converge efficiently to even an approximate Nash equilibrium for every possible game. It’s “a very sweeping negative result,” Roughgarden said.

Economists often use Nash equilibrium analyses to justify proposed economic reforms, Myerson said. But the new result says that economists can’t assume that game players will get to a Nash equilibrium, unless they can justify what is special about the particular game in question. “If you’re trying to figure out if your game will easily find an equilibrium,” said Noam Nisan, a computer scientist at the Hebrew University, “it’s on you to provide the argument why it would be.”

Multiplayer Games

In some simple games, it is easy to spot Nash equilibria. For example, if I prefer Chinese food and you prefer Italian, but our strongest preference is to dine together, two obvious equilibria are for both of us to go to the Chinese restaurant or both of us to go to the Italian restaurant. Even if we start out knowing only our own preferences and we can’t communicate our strategies before the game, it won’t take too many rounds of missed connections and solitary dinners before we thoroughly understand each other’s preferences and, hopefully, find our way to one or the other equilibrium.

But imagine if the dinner plans involved 100 people, each of whom has decided preferences about which others he would like to dine with, and none of whom knows anyone else’s preferences. Nash proved in 1950 that even large, complicated games like this one do always have an equilibrium (at least, if the concept of a strategy is broadened to allow random choices, such as you choosing the Chinese restaurant with 60 percent probability). But Nash — who died in a car crash in 2015 — gave no recipe for how to calculate such an equilibrium.

Aviad Rubinstein helped to show that game players won’t necessarily find a Nash equilibrium.

Tselil Schramm

By diving into the nitty-gritty of Nash’s proof, Babichenko and Rubinstein were able to show that in general, there’s no guaranteed method for players to find even an approximate Nash equilibrium unless they tell each other virtually everything about their respective preferences. And as the number of players in a game grows, the amount of time required for all this communication quickly becomes prohibitive.

For example, in the 100-player restaurant game, there are 2100 ways the game could play out, and hence 2100 preferences each player has to share. By comparison, the number of seconds that have elapsed since the Big Bang is only about 259.

This communication bottleneck means that every possible method for adapting strategies from round to round is going to fail to guide players efficiently to a Nash equilibrium for at least some complex games (such as a 100-player restaurant game with complicated preferences). After all, in each round, the players learn only a bit of new information about each other: how happy they are with the single dinner arrangement that got played. So it will take on the order of 2100 rounds before they know everything about one another’s values (by which time, presumably, the Chinese and Italian restaurants will have gone out of business).

“If this is going to take longer than the age of the universe,” said Sergiu Hart, a game theorist at the Hebrew University of Jerusalem, “it’s completely useless, of course.”

It might seem natural, almost obvious, that players will sometimes need to know everything about each other’s values to find a Nash equilibrium. The new paper shows, however, that this same limitation holds even if the players are willing to make do with an approximate Nash equilibrium — an important finding when it comes to real-world applications, in which an outcome that’s close to a Nash equilibrium is often good enough.

Yakov Babichenko helped to show that reaching a Nash equilibrium might take longer than the age of the universe.

Courtesy of Yakov Babichenko

Babichenko and Rubinstein’s result does not imply that all, or even most, games will be subject to this limitation — only that some games will. Many of the games economists use to model the real world have additional structure that greatly reduces the amount of information each player must communicate. For example, if 100 of us are each choosing one of two routes for our morning commute, you probably don’t care which players go on each route — you only care how many go. That means your collection of preferences will have a high degree of symmetry, and you can potentially convey its entirety in a couple of well-chosen sentences instead of 2100 of them.

Economists could use such arguments to justify why Nash equilibrium might be attainable for particular games. But the new result implies that such justifications must be made on a case-by-case basis; there’s no killer argument that will cover all games all the time.

What’s more, even though many games that have evolved along with civilization may be amenable to such simplifications, the Internet era is giving rise to all kinds of new many-player games, from dating sites to online stock trading. “At this point, we don’t have the slow evolution of humanity that only steers us toward games where it is easy to find an equilibrium,” Nisan said. “We design new games, and if we suppose we’re going to get an equilibrium, we’re very often going to be wrong.”

In real life, people often don’t play games at equilibrium, something that economists are keenly aware of, said Andrew McLennan, an economist at the University of Queensland in Brisbane, Australia. But, he said, “economics doesn’t have any theoretical structure for asking how precise economics can be.” Theoretical computer science results like the new one from Babichenko and Rubinstein “should be an inspiration to address the issue in a formal way,” he said.

But the two fields have very different mindsets, which can hamper interdisciplinary communication: Economists tend to look for simple models that capture the essence of a complex interaction, while theoretical computer scientists are often more interested in understanding what happens as the models grow increasingly complex. “I wish my colleagues in economics were more aware, more interested in what computer science is doing,” McLennan said.

A Trusted Adviser

The new work draws a bright dividing line between Nash equilibrium and another, more general equilibrium concept that came to prominence 24 years after Nash’s paper. “Correlated equilibrium” — proposed in 1974 by Robert Aumann, another economics Nobelist — posits a scenario in which game players each receive advice from a trusted mediator (or “correlating device”) about what strategy to play. The mediator’s advice forms a correlated equilibrium if no individual player has an incentive to deviate from the advice he has received, if he believes the other players are each following their own advice.

This might at first sound like an arcane construct, but in fact we use correlated equilibria all the time — whenever, for example, we let a coin toss decide whether we’ll go out for Chinese or Italian, or allow a traffic light to dictate which of us will go through an intersection first.

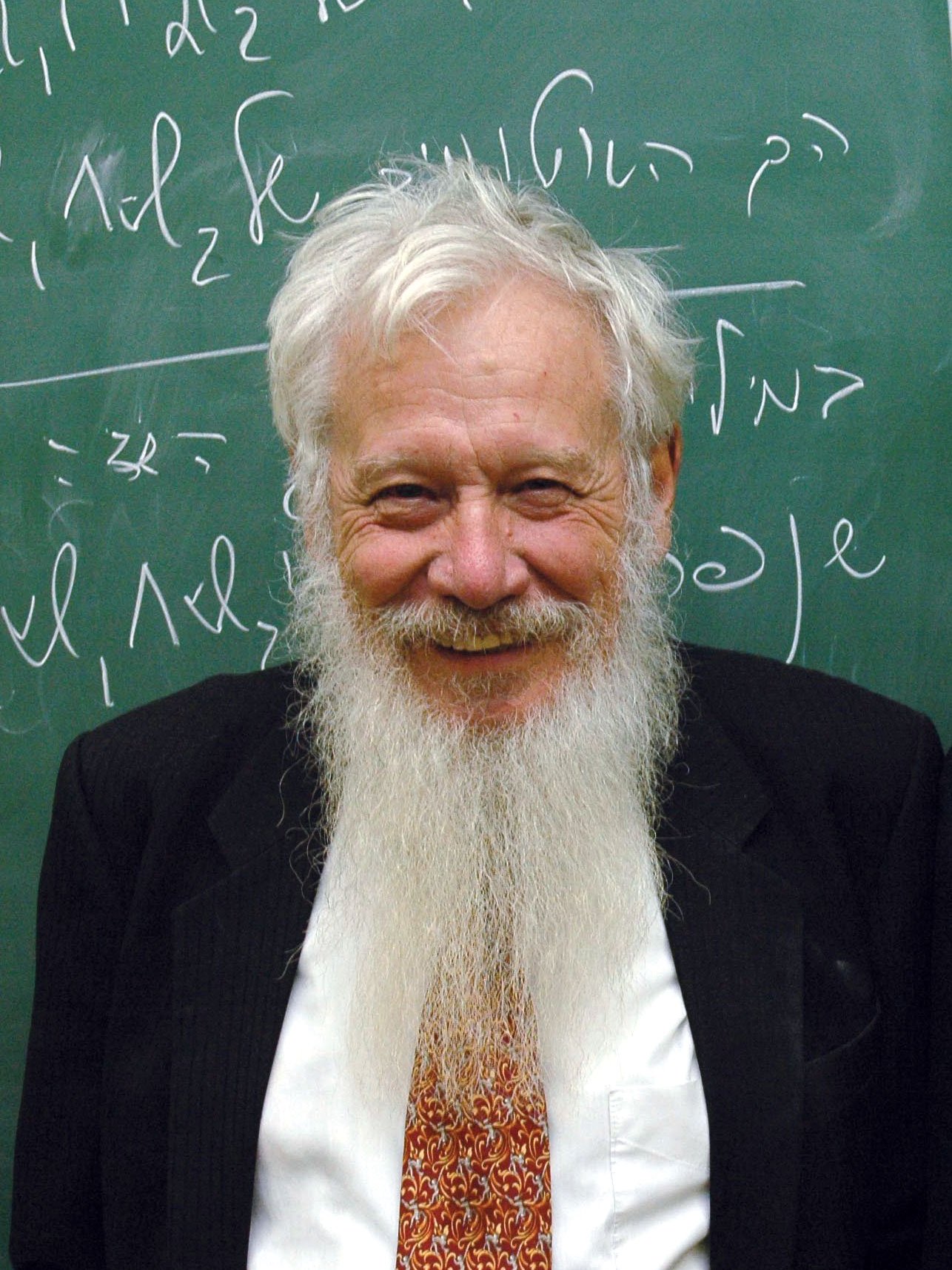

Robert Aumann invented the concept of correlated equilibrium.

Courtesy Dr. Robert J. Aumann

In these two examples, each player knows exactly what advice the “mediator” is giving to the other player, and the mediator’s advice essentially helps the players coordinate which Nash equilibrium they will play. But when the players don’t know exactly what advice the others are getting — only how the different kinds of advice are correlated with each other — Aumann showed that the set of correlated equilibria can contain more than just combinations of Nash equilibria: it can include forms of play that aren’t Nash equilibria at all, but that sometimes result in a more positive societal outcome than any of the Nash equilibria. For example, in some games in which cooperating would yield a higher total payoff for the players than acting selfishly, the mediator can sometimes beguile players into cooperating by withholding just what advice she’s giving the other players. This finding, Myerson said, was “a bolt from the blue.”

And even though a mediator can give many different kinds of advice, the set of correlated equilibria of a game, which is represented by a collection of linear equations and inequalities, is more mathematically tractable than the set of Nash equilibria. “This other way of thinking about it, the mathematics is so much more beautiful,” Myerson said.

While Myerson has called Nash’s vision of game theory “one of the outstanding intellectual advances of the 20th century,” he sees correlated equilibrium as perhaps an even more natural concept than Nash equilibrium. He has opined on numerous occasions that “if there is intelligent life on other planets, in a majority of them they would have discovered correlated equilibrium before Nash equilibrium.”

When it comes to repeated rounds of play, many of the most natural ways that players could choose to adapt their strategies converge, in a particular sense, to correlated equilibria. Take, for example, “regret minimization” approaches, in which before each round, players increase the probability of using a given strategy if they regret not having played it more in the past. Regret minimization is a method “which does bear some resemblance to real life — paying attention to what’s worked well in the past, combined with occasionally experimenting a bit,” Roughgarden said.

For many regret-minimizing approaches, researchers have shown that play will rapidly converge to a correlated equilibrium in the following surprising sense: after maybe 100 rounds have been played, the game history will look essentially the same as if a mediator had been advising the players all along. It’s as if “the [correlating] device was somehow implicitly found, through the interaction,” said Constantinos Daskalakis, a theoretical computer scientist at the Massachusetts Institute of Technology.

As play continues, the players won’t necessarily stay at the same correlated equilibrium — after 1,000 rounds, for instance, they may have drifted to a new equilibrium, so that now their 1,000-game history looks as if it had been guided by a different mediator than before. The process is reminiscent of what happens in real life, Roughgarden said, as societal norms about which equilibrium should be played gradually evolve.

In the kinds of complex games for which Nash equilibrium is hard to reach, correlated equilibrium is “the natural leading contender” for a replacement solution concept, Nisan said.

The fact that humanity came up with the idea of Nash equilibrium before correlated equilibrium may be just an accident of history, Myerson said. “People think that the ideas that evolved earlier are the more fundamental ones,” he said, but in this case, “who’s to say what’s a more fundamental idea?”

Yet the results about fast convergence don’t imply that any individual round of the game is being played at a correlated equilibrium — only that the long-term history of the game is. This means, Rubinstein pointed out, that regret minimization approaches are not always an ideal choice for rational players in any given round. That leaves the question “What will rational players do?” with no definitive answer.

This question “has been explored since before I was born,” said the 30-year-old Rubinstein. “But it’s still the beginning.”

This article was reprinted in Spanish at Investigacionyciencia.es.